FIFTH AVENUE in New York City is the world’s most expensive shopping street once again, according to a new global ranking from real estate services firm Cushman & Wakefield.

The report, “Main Streets Across the World,” showed Fifth Avenue was the most expensive retail district in the United States, with an annual rent of $2,000 per square feet (sq.ft.) or €21,076 per square meter (sq.m.).

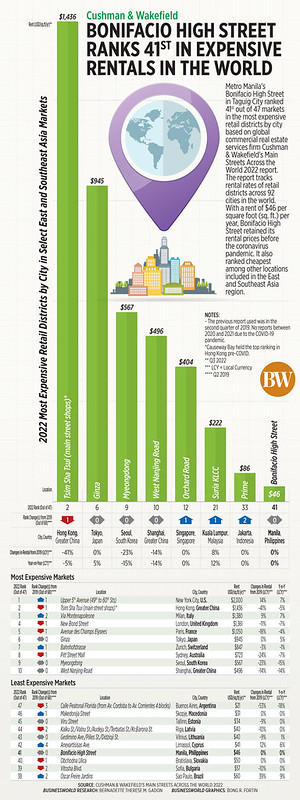

The second most expensive shopping street was Hong Kong’s Tsim Sha Tsui, where rent averaged $1,436 per sq.ft. or €15,134 per sq.m. annually.

Third spot went to Milan’s Via Montenapoleone at $1,380 per sq.ft. per year or €14,547 per sq.m., making it Europe’s most expensive shopping street.

Ranked fourth and fifth respectively were New Bond Street in London and Avenues des Champs Elysees in Paris.

Rounding out the top ten most expensive shopping streets were Ginza in Tokyo; Banhofstrasse in Zurich; Pitt Street Mall in Sydney; Myeongdong in Seoul; and West Nanjing Street in Shanghai.

Bonifacio High Street is the most expensive retail district in the Philippines, but was 41st in Cushman & Wakefield’s global ranking.

However, Bonifacio High Street’s annual rent remained at pre-pandemic levels of $46 (around P2,550) per sq.ft. or €480 (around P28,200) per sq.m., and significantly lower than the rents in Fifth Avenue and Tsim Sha Tsui.

Claro Cordero, director and head of research, consulting and advisory services at Cushman & Wakefield, said the retail environment in the Philippines at the height of the pandemic was similar to other markets when most businesses were put to a standstill.

The Philippines implemented strict lockdowns for most parts of the country starting mid-March 2020 to prevent the spread of the coronavirus disease 2019 (COVID-19). Restrictions have since been lifted.

“(The) high-end retail segment is seen to gain lost grounds in the medium-term, while full recovery of the mid-end retail segment will take a while due to challenges in the growth of consumer spending attributable to the escalating prices of goods and services,” Mr. Cordero said in a statement.

Demand for luxury will continue to grow as wealthy shoppers are undaunted by high inflation, he added.

“In the Philippines, the decoupling of the high-end/luxury and mid-end segment post-pandemic will be largely due to the ability of the luxury brand operators to embrace changes in consumer preference and shopping habits,” Mr. Cordero said.

He noted that new retail space completions in the mid-end segment remained “lackluster as developers reassess expansion strategies in favor of more resilient asset classes.”

“As retail space vacancies in the mid-end segment were still observed to be high compared with pre-pandemic averages, the high-end retail segment has since recovered due to improvement in mall features (such as higher ceiling, better air circulation that mimic ‘outdoor’ spaces) that enhance ‘experiential shopping’,” Mr. Cordero said.

Cushman & Wakefield’s Main Streets Across the World report monitors the top retail streets around the world, ranking the most expensive in 92 cities by prime rental value using the company’s data. The latest report is the first since 2019.

Cushman & Wakefield noted that rents in prime retail districts fell by an average of 13% during the height of the pandemic, but have now rebounded to just 6% below pre-pandemic levels.

Rental growth averaged 2% globally, but this varied by region. Asia-Pacific saw rents plunging 17% on average as border closures hurt tourist hotspots. In EMEA, rents fell by 11%, while the drop in the Americas was at 7%.

Global retail market rents have rebounded by around 50% since the height of the pandemic.

However, this rebound was mostly seen in 2021 and early 2022 before global economic headwinds impacted markets in the last six months, according to Cushman & Wakefield.

“The industry has been through one of the biggest stress tests imaginable over the past few years, but retail real estate has come out of the other side stronger, with brands understanding their customers better than ever,” Robert Travers, head of Europe, Middle East, and Africa (EMEA) Retail at Cushman & Wakefield, said in a statement.

“With further investment in high-quality in-store experiences and advances in omnichannel approaches, we are confident in the resilience of the sector, particularly at the luxury end, and in key global destinations,” he added. — Cathy Rose A. Garcia

If you like this article, share it on social media by clicking any of the icons below.

Or in case you haven’t subscribed yet to our newsletter, please click SUBSCRIBE so you won’t miss the daily real estate news updates delivered right to your Inbox.

The article was originally published in Business World.

More Stories

RRHI first quarter core earnings rise to P1.2 B

BCDA remits P1.1 billion to national coffers

Consunji Group seals deal to buy 90% of Cemex PH for $305.6 M