MANILA – AREIT Inc., Ayala Land‘s real estate investment trust, said Monday it will expand business by pursuing high-yielding prime commercial properties over the next three years.

The company said in its three-year investment strategy that it is interested in income-generating properties, mostly commercial leasing, in prime areas and business districts in Metro Manila or key provinces in the country.

Properties should also have stable long-term occupancy, tenants and income, with minimum contract maturity of 2022 or 2023.

The property firm also considers the quality of tenants and contracts, where the majority of their current tenants are a mix of top multinational and local BPO, and traditional headquarter office locators.

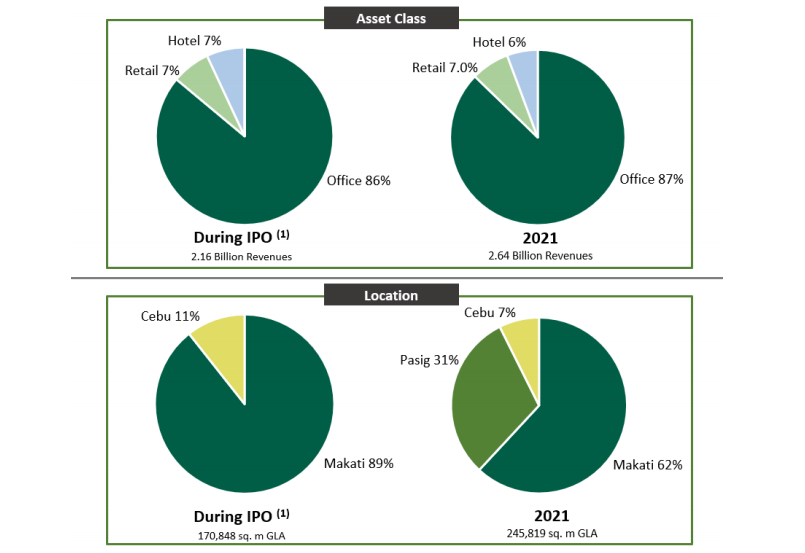

“With the identified assets for acquisition in 2021, the office sector will continue to drive AREIT’s income contributing 89 percent of its revenues in 2021. The expansion to other central business districts and prime locations across the Philippines will allow AREIT to diversify geographically next year,” the company said.

To date, AREIT’s portfolio of properties includes the 24-story Solaris One, Ayala North Exchange, and McKinley Exchange, as well as the Teleperformance office building in Cebu, and The 30th malls in Pasig (formerly known as Ayala Malls The 30th).

AREIT is the first real estate investment trust (REIT) in the country. Since listing at the Philippine Stock Exchange last Aug. 13, the company is 45-percent owned by the public and 54-percent owned by Ayala Land.

#realestateblogph | #realestateblogphpropertynews | #REBPH | #realestate | #AyalaLand | #REIT

Article and Photo originally posted by ABS-CBN News last December 28, 2020, 8:27pm. Minor edits have been made by REBPH to cater to its own readers.

More Stories

Vista Land Celebrates 50 Years with Sandiwa: An Event Honoring Leadership, Legacy, and the Filipino Dream of Homeownership

Vista Land Celebrates Love Month in Ilocos Region

Vista Land Bridges Cebuano Heritage and Progress with Valencia by Vista Estates