The COVID-19 pandemic and dampened demand from the Philippine Offshore Gaming Operators(POGOs) affected the Philippine residential real estate market as property prices plunged for the first time in five years.

Fewer buyers looked for homes, and fewer sellers were willing to list their properties as the entire Luzon was placed under enhanced community quarantine since the middle of March to prevent further spread of the deadly COVID-19.

The pandemic-induced recession caused by the stay-at-home orders led to a noticeable drop in home sales in the National Capital Region (NCR).

RESIDENTIAL REAL ESTATE PRICES

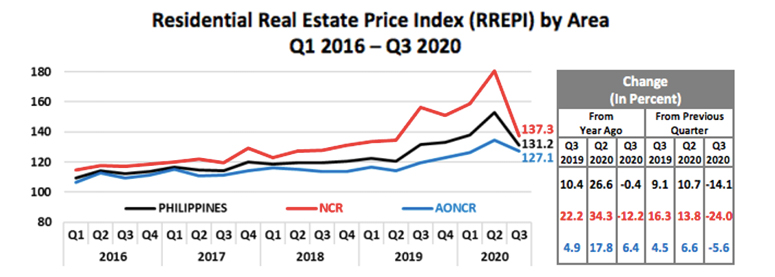

The Bangko Sentral ng Pilipinas (BSP) has reported the country’s residential real estate price index (RREPI) slipped 0.4 percent to 131.2 in the third quarter from 131.7 in the same quarter last year.

“This is the first time that the RREPI posted negative year-on-year growth since the start of the series in Q1 2016,” the BSP said.

The RREPI was launched in the first quarter of 2016 and is used as an indicator for assessing the country’s real estate and credit market conditions. Generally, a price index measures the price changes as a percentage change from some specific start date.

Quarter-on-quarter data showed the RREPI plunged 14.1 percent after surging 27.1 percent to hit a record 149.4 in the second quarter.

“The decline in the RREPI may be partly due to the weak consumer demand for houses and lots,” the central bank added.

The latest Consumer Expectations Survey (CES) showed a low preference of consumers for a property because of the pandemic and economic uncertainty, the BSP said.

AREAS OUTSIDE NCR SEE PRICE HIKES

The property price index in NCR fell 12.2 percent to 137.3 in the third quarter from 156.4 in the same quarter last year, while those in areas outside NCR went up 6.4 percent to 127.1 from 119.4.

Data showed prices of condominium units plunged 23 percent to 154.7 in the third quarter of the year from 182.1 in the same quarter of last year, while that of duplexes declined 8.8 percent to 131.5 from 144.2.

The price of townhouses also increased 12 percent to 155.1 from 138.5 and that of single detached/attached by 7.4 percent to 116.3 from 108.3.

The BSP said residential real estate loans granted for all types of new housing units nationwide meanwhile plummeted by 43.3 percent in the third quarter of the year both in NCR and in areas outside NCR.

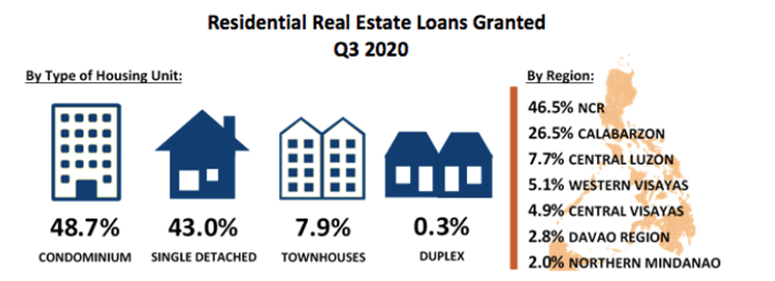

Most of the loans granted in NCR were for the purchase of condominium units, while loans extended in the provinces were for purchasing single detached/attached houses.

In the third quarter, the BSP said the purchase of new housing units accounted for 74.9 percent of residential real estate loans. Most residential property loans were used to acquire condominium units with 48.7 percent, followed by single-detached/attached houses with 43 percent and townhouses with 7.9 percent.

Last August, the BSP’s Monetary Board raised the loan limit to the real estate sector by universal and commercial banks to 25 percent of the total loan portfolio from the previous 20 percent.

BSP Gov. Benjamin Diokno earlier said the move would release P1.2 trillion in additional liquidity for lending to the sector amid the ongoing COVID-19 pandemic.

Data showed disbursements to the real estate sector went up by 6.8 percent to P1.71 trillion and accounted for 19.1 percent of the total loan disbursements in end-October.

Michael Ricafort, chief economist at Rizal Commercial Banking Corp. (RCBC), said the latest year-on-year drop in RREPI in the third quarter largely reflects the adverse effects of the pandemic.

Ricafort pointed out businesses cut costs and capital expenditures, including property, while consumers become more conservative on big-ticket purchases such as homes amid the uncertainties in the labor market.

For one, Ricafort cited the repatriation of more than 300,000 overseas Filipino workers who were displaced in host countries due to the pandemic.

This, according to the economist, led to some reduction in property or real estate purchases.

He also traced the healthy downward correction in residential real estate property prices to the reduced online gambling business due largely to the pandemic that reduced the mobility of POGO workers amid travel restrictions, reduced flights, and higher taxes imposed on the industry.

Ricafort said the BSP’s aggressive rate cuts totaling 200 basis points and which brought the benchmark interest rate at an all-time low of two percent could be an offsetting factor.

“This could stimulate greater demand for loans to finance the purchase of real estate and spur demand for more housing loans to purchase more residential properties,” Ricafort said.

#realestateblogph | #realestateblogphpropertynews | #REBPH | #realestate

Article and Photo originally posted by Property Report Ph last January 8, 2021 and written by Lawrence Agcaoili. Minor edits have been made by REBPH to cater to its own readers.

More Stories

Vista Land Celebrates 50 Years with Sandiwa: An Event Honoring Leadership, Legacy, and the Filipino Dream of Homeownership

Vista Land Celebrates Love Month in Ilocos Region

Vista Land Bridges Cebuano Heritage and Progress with Valencia by Vista Estates